How Do SPDR ETFs Work?

Author: Charles Ouko

When the investment management division of State Street Global Advisors launched shares of the SPDR 500 Trust in 1993, it gave rise to a sort of exchange-traded fund known as a Standard & Poor's Depositary Receipt, or SPDR (SPY). The SPY ETF, sometimes known as "spiders," is centered on the S&P 500 Index, and all shares correspond to ownership in one of the 500 equities that make up the S&P 500. Today, investors have access to several additional SPDR funds; some monitor companies based on market value, while others concentrate on particular market sectors.

Mutual Funds vs. SPY

In contrast to mutual funds, SPDR funds do not issue shares to investors during investment. Instead, SPDRs trade on exchanges like stocks since they have a set number of shares that can be purchased and sold to the public. On the other hand, a mutual fund firm issues and redeems mutual fund shares.

The underlying index's fluctuation is reflected in each unit's value in every SPDR exchange-traded fund at any time. For instance, the SPDR 500 Trust, which trades under the ticker symbol SPY, is intended to trade at a price roughly one-tenth of the S&P 500 level. Although there is no exact correlation, if the S&P 500 is at 2,000, the ETF stocks will trade at about $200.

Sectors and Capitalization for S&P

Market capitalization and industrial sectors of the S&P 500 are the focus of SPDR ETFs, which were developed specifically for this purpose. Examples of exchange-traded funds (ETFs) based on market value are SPDR Portfolio S&P 600 Small-Cap ETF and SPDR Portfolio S&P 400 Mid-Cap ETF. State Street Global Advisors revealed index and name change for some of these ETFs on January 24th, 2020:

Additionally, State Street has developed SPDRs based on several S&P 500 sectors, including SPDR Financials (XLF), SPDR Basic Materials (XLB), and SPDR Energy (XLE). The sector funds hold the 500 equities in the S&P 500.

Hedging, Futures, and Options for SPDR

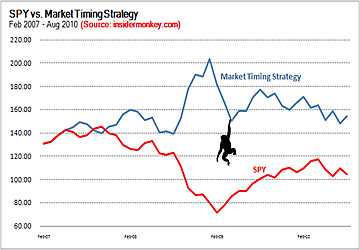

Shares of SPDR ETFs can be sold short because they trade similarly to equities. Options linked to the individual performance of many ETFs are also available and can be used as a hedge. For example, investors will profit if the S&P 500 Index rises if they have a major stake in the S&P 500 SPDR ETF or the stock market. Conversely, the investor will experience investment losses if the index declines. But some risks might be reduced if that investor hedges their positions by either shorting the SPDR or purchasing put options, a strategy known as market hedging.

Final Verdict

Individual investors have access to opportunities through SPDR ETFs. Shares can be purchased to match a market's or an index's performance. Additionally, SPDRs have the option to provide a deeper level of market coverage through ETFs that follow a wider index. Alternately, an investor might place a focused wager by purchasing an SPDR that focuses on a certain industry or market capitalization. Additionally adaptable, SPDRs can be utilized as hedging tools.